Deal Manager To Go Online Support

Reporting

Deal summary

![]()

This Report will return your activity for the year and month selected. This is not a

Revenue report and is not to be used for Income Tax purposes.

To view your Deal Summary for a particular year; click on Reports, then

choose Deal Summary and then choose the year then month in question as shown

above.

It will show you the amount of

·

Firm Deals in the month and year selected and the Ends, Sale Prices and

Commission amounts associated with each Firm deal

·

Your outstanding conditional deals and the

Ends, Sale Prices and Commissions amount associated with each Conditional deal

·

Any deals that have not paid in to you or

the brokerage from prior years

Revenue Summary

![]()

![]()

This report returns all deals paid to you for the year selected. This can be used for Income Tax purposes.

To view your revenue summary for a particular year; click on Reports,

then choose Revenue Summary and then choose the year in question as shown

above.

It will show you your

·

T4A Income Year to Date

·

GST/HST collected Year to Date

·

Your deduction amounts per cheque such as

o Charity/Donation

o Service Fees

o AR

o Staff Funds etc

·

A Deduction summary of all your deduction

accounts and the total amount collected and paid out from each account

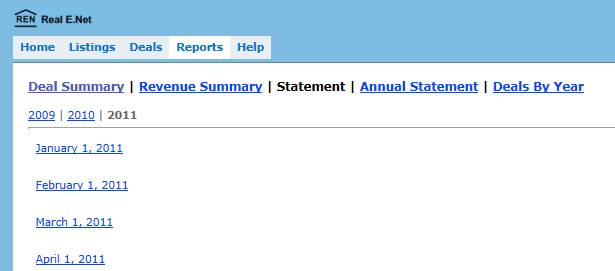

Statements

![]()

![]()

![]()

![]()

These are your monthly expenses from the brokerage.

To view any statement that the brokerage has processed in Real E.Net;

Click on Reports, then Statements, and then the year and statement period you

would like to see as show above.

Annual Statements

![]()

![]()

![]()

These are your monthly expenses from the brokerage summarized in to one

annual report. It will give you a month by month breakdown of all brokerage

expenses incurred throughout the year.

To view your annual statement; Click on Reports, then Annual Statement,

and then the year you would like to see as show above.

Deals By Year

![]()

![]()

This report will give you deals Written in a year. So deals that have a

sale date in the year selected.

To run the Deals by Year report; Click on Reports, then Deals by Year,

and then the year you would like to see as show above.